The Path of a Medical Claim: From Submission to Resolution

December 12, 2025

Medical billing is an obstacle course, a maze with detours and checkpoints. Claims zig-zag through multiple reviewers, sometimes bounce back for corrections, and occasionally hit a dead end before payment finally arrives. But once you understand the path a claim follows, it’s much easier to keep things moving and avoid costly delays.

Here’s the journey every claim takes from start to finish, and why knowing the difference between a rejected claim and a denied claim is critical for billers and practice managers.

Step 1: Medical Claim Creation and Coding Accuracy

Every claim begins with a patient visit, also known as an encounter. Before services are rendered, the front desk team compiles the necessary details such as patient demographics and insurance information. During or after the encounter, the procedure codes that describe the service are recorded. This step is foundational for the whole journey. If the claim isn’t built correctly here, the rest of the trip is going to be bumpy. Even a small typo or missing field can delay the process before it even really gets going. Our pro tip: always double-check that all fields are completed accurately.

Step 2: Clearinghouse Submission and Possible Claim Rejections

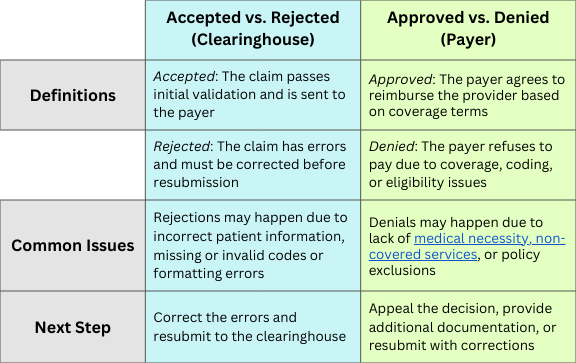

Next stop: the clearinghouse. This third-party intermediary checks for formatting errors, missing details, or invalid codes before allowing the claim to proceed to the payer. After being thoroughly checked, the claim will have one of two statuses:

Accepted at the Clearinghouse: The claim passes inspection and moves on to the insurance company or payer. (That’s a good sign, but not the finish line.)

Rejected at the Clearinghouse: The claim contains errors and is immediately sent back to the biller. Since rejected claims never reach the payer, they have to be corrected and resubmitted before anything else can happen.

Key takeaway: Rejections are roadblocks at the gate, not final denials. Fixing them quickly keeps claims moving forward.

Step 3: Insurance Payer Review, Payments, and Denials

Once the claim clears the clearinghouse, it heads to the payer for an even deeper review. This is the stage where coverage rules, medical necessity, and coding accuracy are all put under the microscope. The payer also checks eligibility and contract terms.

If everything checks out, the claim is approved and payment is processed based on the patient’s policy. The approval may not cover the full billed amount. Deductibles, co-pays, or contractual write-offs can still apply, but at least money is on its way. If something doesn’t line up, however, the claim is denied and reimbursement is refused. Denials can happen for many reasons, such as lack of coverage, mismatched codes, non-covered services, or a failure to meet medical necessity standards.

Key takeaway: Unlike rejections, a denial means the claim did reach the payer but didn’t get approved. Denials require follow-up, appeals, or additional documentation.

Step 4: Explanation of Benefits (EOB) and Remittance Advice (RA)

After review, the payer issues a Remittance Advice (RA) or Explanation of Benefits (EOB). The RA is commonly delivered electronically now, known as an ERA. This document tells the full story: what was paid, what portion is the patient’s responsibility, and the reasoning behind any denial. If a denial occurs, the provider can appeal, submit a corrected claim, or send additional documentation to justify the services.

Step 5: Patient Billing and Collections Process

If insurance leaves part of the balance unpaid, the provider bills the patient. By managing denials efficiently and monitoring claims along the way, billers can minimize surprises and keep revenue flowing more smoothly.

Clearinghouse vs. Payer-Level Claim Decisions: The Big Difference

Why Understanding the Medical Claim Process Matters

Knowing the lifecycle of a claim and where it can potentially get stuck is the best way to keep it moving. Accurate submissions cut down on rejections, solid coverage checks and correct coding reduce denials, and quick action on problems keeps the cash flow steady. Roughly 70% of denied claims ultimately get overturned and paid. Reporting tools, like OpenPM’s Denial Analysis Report, can also help identify recurring issues and prevent the same mistakes from happening again.